Key points when foreigners apply for permanent residency in Japan(②): Overseas property inherited from parents living in the home country is also taxable.

Today is the second column about points foreign nationals need to remember when obtaining permanent residence. One specific scenario I will examine is when foreign individuals residing in Japan inherit property from their parents who live overseas. In such cases, it is essential to understand how the Japanese inheritance tax will be applied to the […]

Key points when foreigners apply for permanent residency in Japan(①): “Exit Tax from Japan” on unrealized capital gains.

According to a report by the Nikkei Shimbun on August 21st, the Japanese government will take budgetary measures to allow foreign residents to apply for permanent residence online from fiscal 2025. The government aims to attract more foreign workers and expects to increase the number of applications for permanent residency. Indeed. We will see increased […]

Changes to the rules on inter vivos gift and inheritance tax (Part 1): The revision of "the calendar year taxation system" for gift tax

Weekly magazines often feature articles about changes to inheritance and gift taxation rules, urging readers to take action before new regulations take effect. Starting on January 1, 2024, the Tax Reform Act will impose significant limitations on "the calendar year taxation system" for gift tax, a commonly used measure to lower inheritance tax. On the […]

Can the renovation costs before starting the real estate leasing be necessary expenses for the year?

During my participation in free consultations for general taxpayers hosted by the Certified Public Tax Accountants Association, I am frequently asked a common question. To newly rent an old house or condominium to a third party, they undergo renovation work such as:・Reupholstering of “tatami” or mats, flooring, “fusuma” or wallpaper,・Renewal of plumbing equipment such as […]

Benefits of having a bank account dedicated to freelance work

I often receive the following question from ex-pats starting freelance work in Japan. "I'm thinking of using the blue return system, but how should I think about the bank account to receive revenues? I have already opened a payment account for a credit card for personal shopping, etc. Is it okay to use it for both […]

Are derivative transactions in foreign markets subject to separate or comprehensive Taxation?

An increasing number of individual investors are conducting derivative transactions in foreign markets through securities companies headquartered overseas, with underlying assets such as foreign stocks, foreign stock indices, and foreign exchanges. The prices of these derivative transactions generally fluctuate more than the price fluctuations of the underlying assets. As a result, the investor enjoys more […]

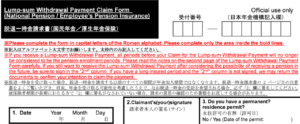

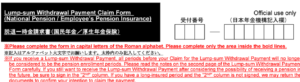

Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension" (Part 2)

Today, following Part 1 of my blog dated October 12, "Lump-sum Withdrawal Payments from the Employees' Pension(Part 1)," I will introduce points to keep in mind when filing a tax refund return. 目次(Table of contents)1 The waiting period till receiving the payment2 When can you file a tax return for a refund?3 Points to keep […]

Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension"(Part 1)

I firmly notice that inquiries or consultations have increased about income tax on lump-sum withdrawal payments from Employees’ Pension, etc., from those who leave Japan to reside in other countries. The lifting of travel restrictions to prevent Covid-19 may affect this. I want to explain the following points in this and the following blog: What […]

The scope of taxable properties when you receive ones as gifts from your parents overseas

Seniors worldwide want to support the living and growth of their children and grandchildren as far as circumstances permit. Today, I would like to focus on the following if foreigners living in Japan received a gift of property from their parents who had never set foot in Japan: Is only "property in Japan" (domestic property) […]

Business commencement expense(Kaigyou-hi、in Japanese)

Business commencement expense(Kaigyou-hi、in Japanese)is an item related to all people who start a self-employed business in Japan, regardless of nationality. However, not all the expenses incurred before opening a sole proprietorship can not be business commencement expenses. If you apply wrongly, the tax office may point out you. On the other hand, a better understanding […]