The scope of taxable properties when you receive ones as gifts from your parents overseas

Seniors worldwide want to support the living and growth of their children and grandchildren as far as circumstances permit.

Today, I would like to focus on the following if foreigners living in Japan received a gift of property from their parents who had never set foot in Japan:

- Is only "property in Japan" (domestic property) subject to taxation?

- Or is it taxable, including "property in a foreign country" (foreign property)?

- Are there any other points to keep in mind?

(Note)

The scope of taxable properties under the gift tax also differs from the situations of people who donate properties (donors).

However, the blog post would be extended if I described them all.

Today, I will write on the premise that "the donor has never had an address in Japan."

○The following is my grandchildren when I went on an excursion with my children’s family the other day.

目次(Table of contents)

”Domestic Property" and "foreign Property"

In the first place, how does the gift tax distinguish between "domestic property" and "foreign property"?

The gift tax determines the "location of the property" following the Inheritance Tax Law, based on when the recipient acquires the property right through the gift.

And the criteria for judging the "location of property" varies by property.

Real Estate

Most easy to understand.

It is the "location of real estate".

For example, a "condominium in Hawaii" is a "foreign property" because it is real estate located in Hawaii.

Bank savings, etc.

Money in the bank is the most common but confusing part.

The law stipulates that deposits and savings with financial institutions are "the location of the business office (in the case of a bank, usually the head office business department or a branch office) that accepted the deposit, savings, etc."

In other words, it is neither the location of the head office of the bank nor one of the financial institutions where the donor applies the overseas remittance.

I will give an example.

Suppose the British recipient receives a remittance of the gift from a parent living in the UK to a bank account opened at the Tokyo branch of one headquartered in the UK.

In this case, it becomes "domestic property."

On the other hand, if a parent makes the above remittance to the recipients' bank account opened at the London branch of the same bank, it becomes "foreign property."

Others

Other rules for distinguishing assets are as follow.

| Insurance, incluging rights in the contract of insurance | The location of the head office of the insurance company, etc. |

| Securities such as stocks and corporate bonds are held in custody at security firms, etc. | The location of the security firm's business office where the account is open |

| Government bonds or local bonds | ・If it is a Japanese government bond or a Japanese local government bond, it is "domestic property." ・A government bond issued by a foreign government or a municipal bond issued by a foreign municipality is "foreign property." |

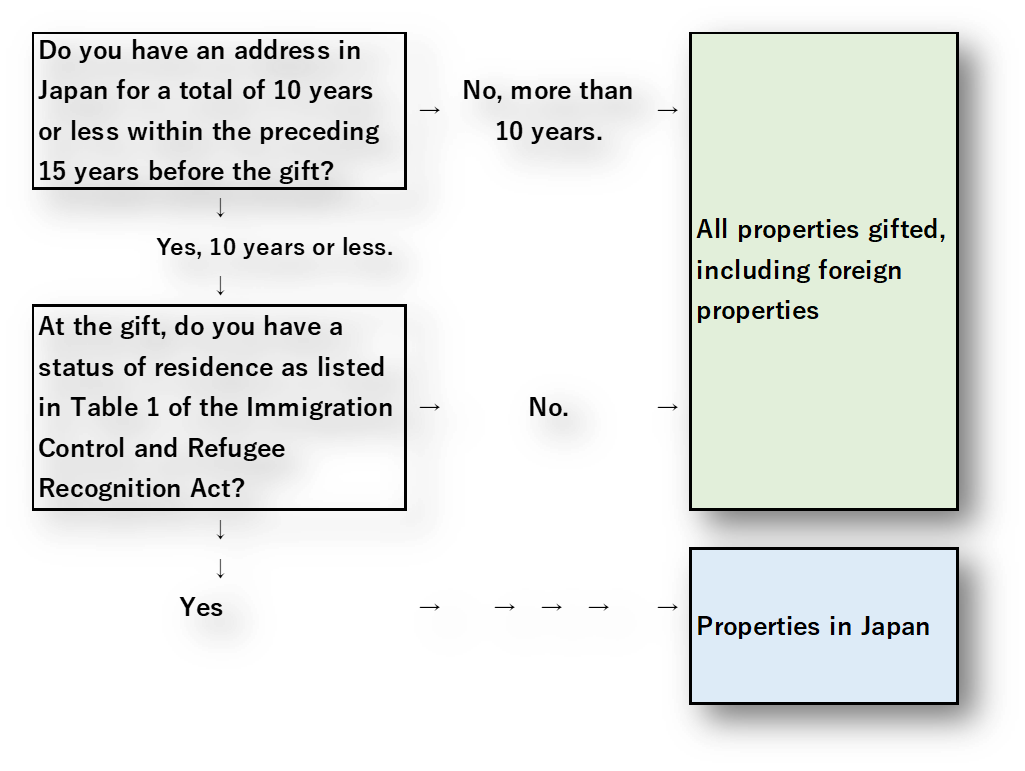

Only "domestic property"? Or is it taxable, including "foreign property"? ‥Two things to check about the scope of taxable properties

If both of the following apply to non-Japanese gift recipients, the scope of taxable properties for them is only "properties in Japan" or domestic pproperties.

- If they have addresses in Japan for an aggregate(not consecutive) of ten years or less within the last fifteen years before the gift

- At the gift, if their residence status is listed in the Attached Table 1(※) of the Immigration Control and Refugee Recognition Act.

※ Diplomat, Journalist, Highly Skilled Professional, Business Manager, Intra-Company Transferee, Student, and others, in total twenty-five statuses of Residence.

In other words, if non-Japanese gift recipients cannot meet either, they are taxed all properties gifted including foreign properties.

I would like to take a closer look at not being residence status is listed in the Attached Table 1.

There are four Statuses of Residence: Permanent Resident, Spouse or Child of Japanese National, Spouse or Child of Permanent Resident, and Long-Term Resident.

Among those four, the easiest one to understand would be "Spouse or Child of Japanese National. (※※)."

It sounds close to "standard Japanese", doesn't it?

Japan's government sees those with this status just like the Japanese and taxes them on all properties, including overseas ones.

※※ The spouse of a Japanese national, a child specially adopted by a Japanese national or those born as the child of a Japanese national

In summary, I express the above as a judgment flow in the below diagram.

When handling remittances from overseas or ones to overseas based on the amount exceeding 1 million Japanese yen, financial institutions operating in Japan must notify the National Tax Agency of the followings:

- the amount of money handled both in a foreign currency and Japanese yen,

- the date of remittance,

- the recipient's name and bank account number, etc.

Thus, the tax authorities keep a close eye to grasp international money flows and wealth accumulation overseas.

Based on this reporting system, the tax office makes inquiries to foreigners saying, "You received a remittance from your relatives oversea, didn’t you? May I ask about…".