Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension"(Part 1)

I firmly notice that inquiries or consultations have increased about income tax on lump-sum withdrawal payments from Employees’ Pension, etc., from those who leave Japan to reside in other countries.

The lifting of travel restrictions to prevent Covid-19 may affect this.

I want to explain the following points in this and the following blog:

- What is the "Lump-sum Withdrawal Payment for Employees' Pension" for expats?

- How is tax calculated?

- What points to keep in mind when filing a tax refund return?

Today, I’ll cover the above two.

目次(Table of contents)

What is the "Lump-sum Withdrawal Payment from Employees' Pension" for expats?

All people living in Japan aged between 20 to 59 must enrol on Japan's public pension system.

Nationality doesn't matter.

On the other hand, the eligibility to receive the public pension is a "payment period of 10 years or more".

In that case, if non-Japanese workers leave Japan to reside in other countries before the above period, they never get benefits even though they have paid premiums.

Not to let paid premiums be forfeited, a system called "Lump-sum Withdrawal from Employees' Pension" has been established.

What are the requirements for receiving the "Lump-sum Withdrawal Payment from Employees' Pension"?

When you, an expat, leave for another country, you can receive the prescribed amount if you meet the following requirements.

- You do not have Japanese nationality.

- The number of months of the National Pension contribution-paid period or the number of months of the Employees' Pension Insurance enrollment period (including the Mutual Aid Association Pension enrollment period and others) is six months or more.

- You were never eligible to receive a pension (including disability allowance).

- You do not have an address in Japan.

Required procedures

The persons leaving Japan must submit the following:

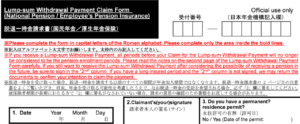

- "Lump-sum Withdrawal Payment Claim Form (National Pension/Employees’ Pension Insurance)” with documents to be attached to the Japan Pension Service or other related parties(such as Promotion and Mutual Aid Corporation for Private Schools of Japan)

- within two years from when they no longer have an address in Japan.

Here, one thing should be noted.

If you send the form and receive a Lump-sum Withdrawal Payment, all periods before your Claim will no longer be considered the pension enrollment period.

Namely, you never get benefits from Japan's public pension system.

How is tax calculated on "Lump-sum Withdrawal Payment from Employees' Pension"?

Suppose expats receive the lump-sum withdrawal payments for the Employees' Pension Insurance after they leave Japan.

In that case, the Income-tax law deems it "retirement income" as a non-resident's domestic source income.

And the law requires the payers to withhold* tax at a rate of 20.42% (including Special Income Tax For Reconstruction) on the amount from the payment at the source.

* In the case of the Lump-sum withdrawal payment for the National Pension, the income tax is not withheld at source.

However, an expat, who is now a non-resident, can apply retirement income deductions in the same way as a resident by filling out the "Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer's Option" to the tax office.

As a result, an expat may be eligible for a full or partial refund of the tax withheld.

【For your reference】

A summary of the tax calculation of a resident's retirement income is below.

At the end

That's all for today. Until the end, thank you for reading.

In the next blog, I'll explain "What points to remember when filing a tax refund return?"

※ For your inquiries, please click the button below, fill in the prescribed form, and send it.