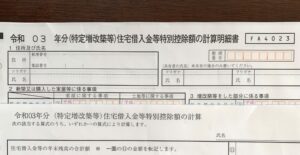

Foreigners in Japan are also eligible for housing tax credits.

Last month, the Nation Tax Agency announced roadside prices for 2022.(“Roadside prices”, Rosen-ka(路線価)in Japanese, are assessed values of lands facing a major road for inheritance tax and gift tax purposes.) According to it, compared to 2021, the land price has risen the most in Hakuba Village, Nagano Prefecture. National newspapers reported that the main reason […]

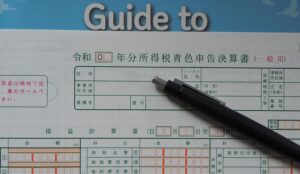

Necessary expenses:Part1

There is an article on the National Tax Agency (after the NTA) website about the scope of "necessary expenses." "Necessary expenses" sound plain and easy, but it's hard to explain to taxpayers. I pay tribute to the NTA for summarizing this subject in English. But, it is undeniable that there is a lack of further […]

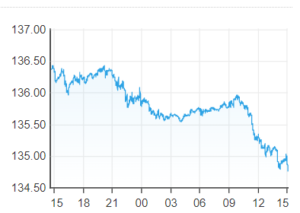

Just "foreign exchange rate", but "foreign exchange rate."

The yen depreciation or fluctuations in the exchange rate are reported daily. Today, with people such as below in mind,・ Foreigners living in Japan who have properties in their home country,・ Or a Japanese who returned to Japan while making financial assets locally when assigned, I will describe the yen conversion rate when conducting transactions […]

A "non-permanent resident" Part 2

目次(Table of contents)1 Review of the previous blog2 The range of "remittances" to be taxed is more expansive than you suppose from words.3 Likely overlooking "Remittance Taxation."3.1 Amount of remittance and taxable income3.2 What we can see from the above4 At the end Review of the previous blog For non-permanent residents, Japan's taxable income on […]

A "non-permanent resident" Part 1

目次(Table of contents)1 What is a "non-permanent resident"? 2 How do you calculate " having an address or domicile in Japan for an aggregate period of five years or less within the preceding ten years the preceding ten years"?2.1 The preceding ten years2.2 An aggregate period3 Scope of taxable income tax What is a "non-permanent resident"? Under […]