Just "foreign exchange rate", but "foreign exchange rate."

The yen depreciation or fluctuations in the exchange rate are reported daily.

Today, with people such as below in mind,

・ Foreigners living in Japan who have properties in their home country,

・ Or a Japanese who returned to Japan while making financial assets locally when assigned,

I will describe the yen conversion rate when conducting transactions in foreign currencies.

In principle, the yen conversion rate is TTM or the midpoint between TTS and TTB on the trading day.

However, for capital gains/losses of transfer of stocks or certain incomes, provided that the same calculation is applied continuously,

・The TTB can convert amounts of revenues and other income or assets on the transaction date, and

・The TTS can convert purchases and other expenses or liabilities.

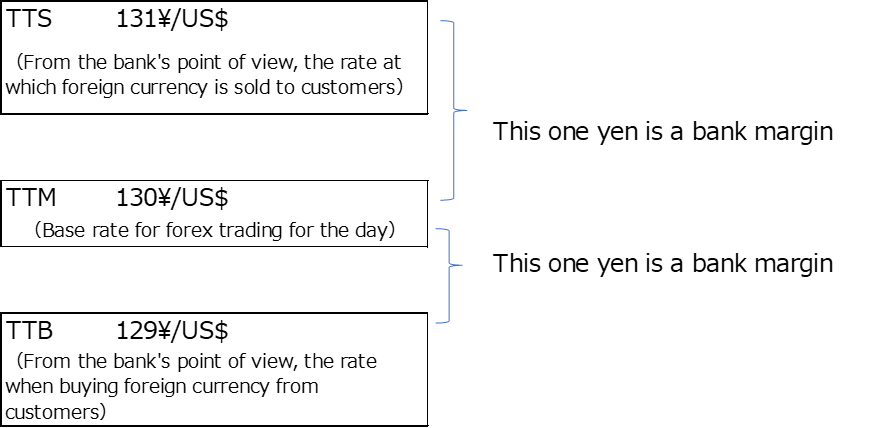

These TTS and TTB reflect the bank's margin against TTM.

The calculation example below shows that if taxpayers use TTB for sales or income and TTS for purchases or expenses, taxable income becomes lower when calculated by the TTM.

目次(Table of contents)

- 1 The principle of conversion rate is TTM. What are TTM, TTS, and TTB?

- 2 Capital gain income from the transfer of foreign currency-denominated stocks and certain financial assets

- 3 Real estate income, business income, forest income, and miscellaneous income pertaining to business operation

- 4 Capital gains on real estate abroad

- 5 Comparison of taxable income calculated by TTM or TTS and TTB

- 6 At the end

The principle of conversion rate is TTM. What are TTM, TTS, and TTB?

It is TTM on the transaction date when an individual makes "foreign currency transactions".

"Foreign currency transactions" mean all transactions delivered and paid in foreign currencies.

A typical example is:

・ Purchase and sale of foreign-currency-denominated financial assets and real estate,

・ Foreign currency-denominated securities futures trading,

・ Business income, real estate income, etc. in foreign currency

・ Dividends on foreign stocks, etc.

What are TTM and TTS / TTB?

What is TTM?

It is an abbreviation for "Telegraphic Transfer Middle Rate" in English and is called "mid-price(Nakane)".

This is the reference rate for "the day" when a financial institution conducts foreign exchange transactions with customers.

The financial institution will also determine TTS and TTB (*) centred on TTM, consider the bank's margin, and show them on its displays of branches or its website.

* TTB and TTS are abbreviations for "Telegraphic Transfer Buying Rate" and "Telegraphic Transfer Selling Rate", respectively.

For the relation between TTS, TTM, and TTB, see the table below using Yen / US $ as an example.

Income where only principle TTM applies

As for "Interest income", "dividend income", "employment income", and "miscellaneous income, not pertaining to business operation", only TTM is applicable.

Capital gain income from the transfer of foreign currency-denominated stocks and certain financial assets

Taxpayers are expected to use TTB for "Proceeds" and TTS for "Cost Basis" in principle.

Not TTM.

This stems from “Fundamental directives of income tax of the National Tax Agency.”

(You can see it on NTA’s website, even though it is written in Japanese)

Real estate income, business income, forest income, and miscellaneous income pertaining to business operation

The principle is TTM mentioned above.

However, as an "especially accepted method",

・the amounts of sales and other income or assets may be converted by the TTB rate on the transaction date,

・while the TTS rate may convert purchases and other expenses or liabilities,

provided that the same calculation is applied continuously.

In a later section, I'll show you a calculation example, but you'll surely get less taxable income with this "especially accepted method" than with the "principles" TTM.

Please note that the miscellaneous income for which this "especially accepted method" exception can be used corresponds to one penetrating operation.

It is said that penetrating operation is "a continuous act to make money".

Therefore, for example, miscellaneous income related to futures trading or FX with financial instruments, whose number of transactions during the year to be declared is low, may not be granted this method.

If you are not confident, please counsel a professional tax accountant when filing your tax return.

Capital gains on real estate abroad

In principle, it is TTM.

However, the followings are also allowed:

・ If the foreign currency received as the transfer price is immediately sold and converted into yen, the income be converted by TTB,

・ If you purchase a foreign currency in yen and presently use it for the asset's acquisition or transfer cost, the acquisition or transfer be converted by TTS.

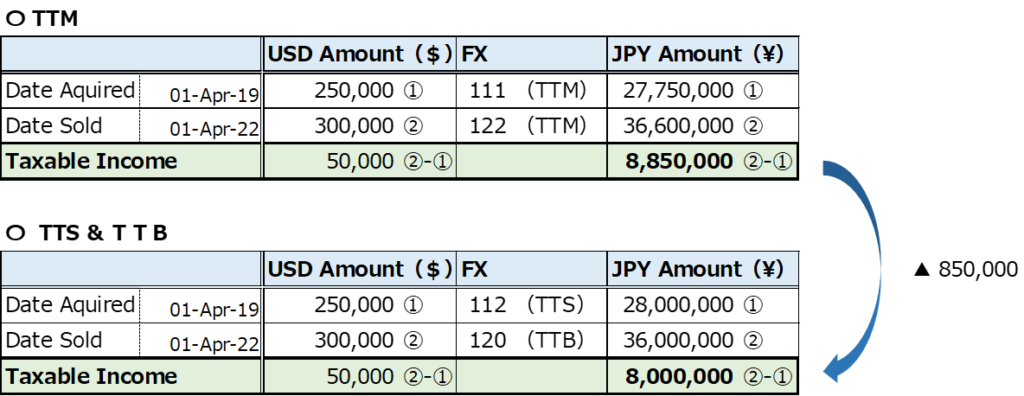

Comparison of taxable income calculated by TTM or TTS and TTB

Please see the table below.

This is an example of a trial calculation when each method converts the transfer transaction into yen.

■On a foreign currency basis (US dollars)

① Acquisition cost of $ 250,000,

② Proceedsof $ 300,000,

③ Taxable income amount of 50,000 dollars(②-①)

Compared to the principle TTM case, if you use

・ TTB, which is lower by the bank margin for income,

・ and TTS, which is more expensive by the bank margin for expenses (acquisition costs),

the taxable income will decrease proportionally (\ 850,000 in the above example).

Not surprisingly, the larger the size of a foreign currency transaction, the more significant the impact of the converted taxable income in yen.

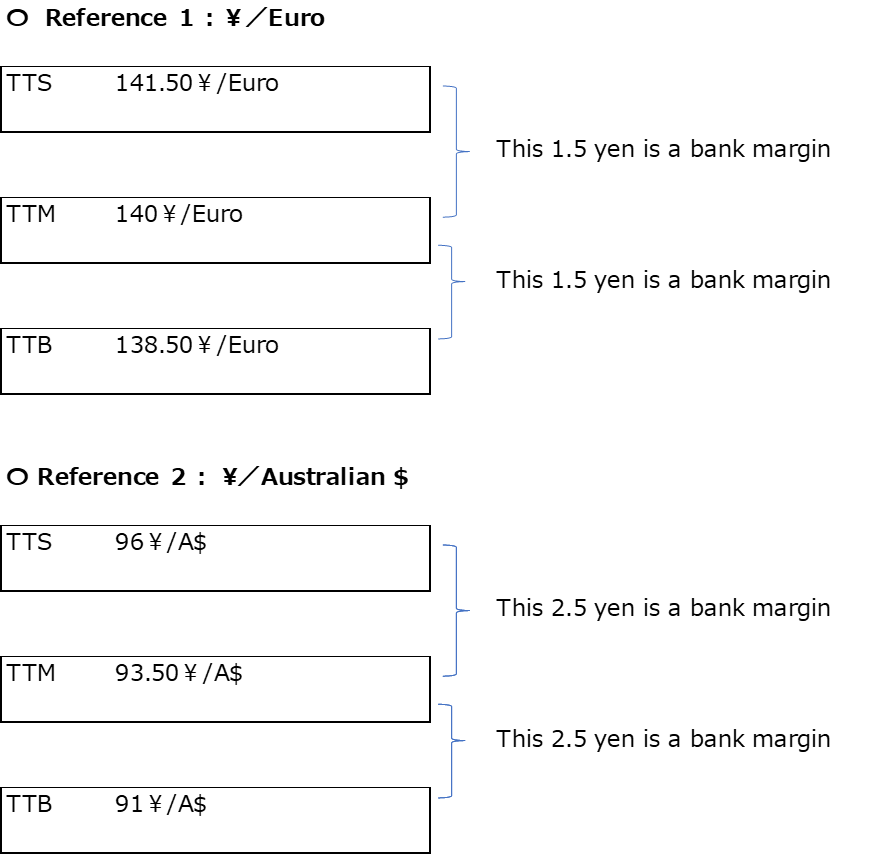

For your reference, in other currencies, this margin is generally wide.

The impact on the amount of income on a yen basis will be even more significant than that of the US dollar.

At the end

Just "foreign exchange rate", but "foreign exchange rate".

The current tax system allows (although some) the yen conversion method, which is advantageous for taxpayers for the portion equivalent to the bank margin.

Please make a wiser declaration by properly using the method allowed by law.