A "non-permanent resident" Part 1

目次(Table of contents)

What is a "non-permanent resident"?

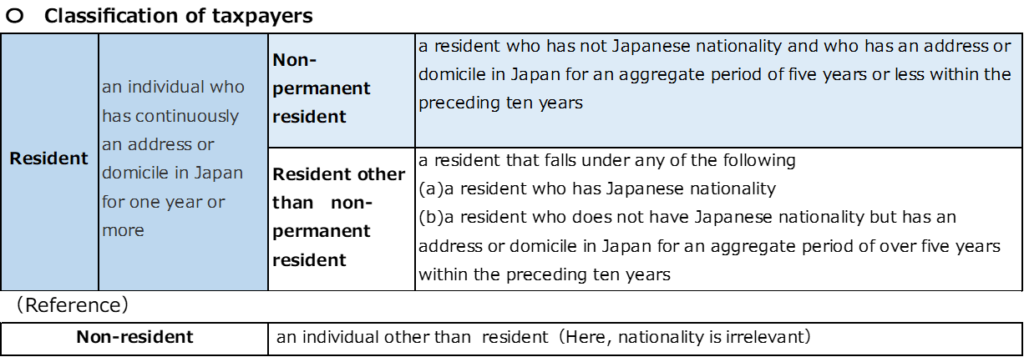

Under Income tax law, the scope of taxable income is determined by your residential classification.

It is vital to make sure what your classification is or will be.

First, you are divided into a non-resident or a resident if you have maintained residence or domicile in Japan for more than one year until now.

Further, a resident varies between a non-permanent resident and a resident other than non-permanent resident, depending on:

1)whether or not you have Japanese nationality,

2)and length of your residence or domicile in Japan.

Concretely, among residents, an individual:

1)who does not have Japanese nationality,

2)and who has had an address or domicile in Japan for an aggregate period of five years or less within the preceding ten years,

is classified as a non-permanent resident.

In summary, it is as follows.

Therefore, the following individuals often fall under the category of non-permanent residents:

1)A foreign businessman comes to live in Japan in response to a transfer order from an overseas company, with expected tenure of more than one year.

2)A non-Japanese sole proprietors who have been in Japan for more than one year.

How do you calculate " having an address or domicile in Japan for an aggregate period of five years or less within the preceding ten years the preceding ten years"?

The preceding ten years

" The preceding ten years" means "from the same day ten years before the reference date, to the day before it."

If the reference date is January 1, 2022, which is the starting date of the 2022 tax return calculation,"the same day ten years before the reference date" is January 1, 2012.

And, "the day before it" is December 31, 2021.

An aggregate period

The starting date of a period when you have maintained a domicile or residence in Japan is the day after the entry date to Japan.

On the other hand, the ending date is the day when you leave Japan.

And, if you have multiple periods (due to leaving and re-entering Japan several times), you have to add the number of years, months, and days of each period.

If the "total period" is five years or less, you are a non-permanent resident, and if it exceeds five years, you are a permanent resident.

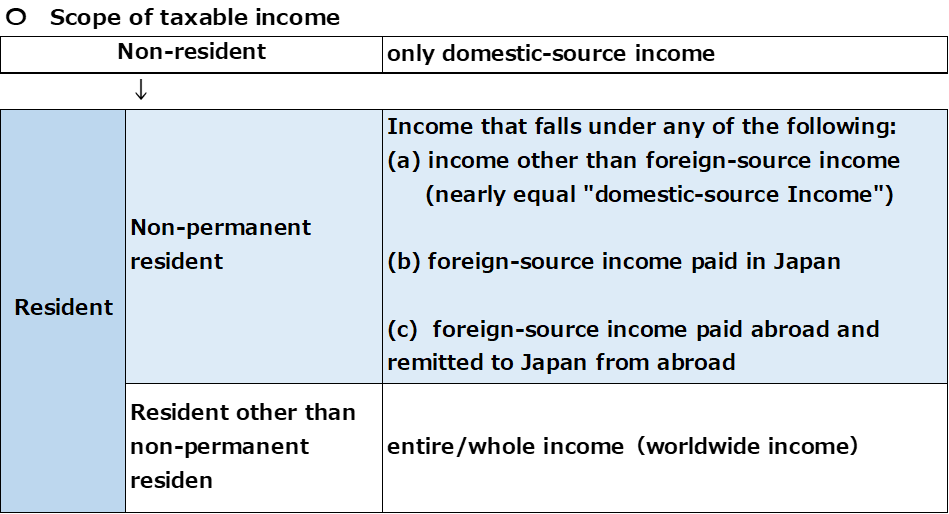

Scope of taxable income tax

Please see the table below.

Foreign nationals exceeding five years within the preceding ten years("resident other than non-permanent resident"), likewise "Ordinary Japanese" born with Japanese nationality and have been raised and lived in Japan, taxes can be applied for entire/whole income.

Compared to this, the scope for a non-permanent resident is limited.

However, the point here is a proper understanding of "foreign-source income paid abroad and remitted to Japan from abroad" or "foreign-source income paid in Japan."

I will write about these in another blog.

2 thoughts on “A "non-permanent resident" Part 1”

Comments are closed.