A "non-permanent resident" Part 2

目次(Table of contents)

Review of the previous blog

For non-permanent residents, Japan's taxable income on income tax falls under any of the following.

- Income other than foreign source income (nearly equal to "non-foreign source income")

- Foreign source income paid in Japan

- Foreign source income paid abroad and remitted to Japan from abroad

Non-foreign source income is taxed in the year when it is all earned, regardless of where it is earned or remitted to Japan.

In contrast, foreign source income is taxed when paid in Japan or sent to Japan(after this "Remittance Taxation").

The range of "remittances" to be taxed is more expansive than you suppose from words.

"Remittance from abroad" is not limited to traditional international bank transfers.

It is regarded as "remittance from abroad" even in the following cases.

Please be careful, particularly the first one.

- Purchasing in Japan with a credit card or the like whose settlement account is a bank account opened overseas and making payments with that card.

- An act of withdrawing money from a bank account outside Japan by using its cash card in Japan.

- An act of carrying or sending currency, precious metals, public and corporate bonds, stocks, and other similar items into Japan.

Likely overlooking "Remittance Taxation."

The amount "remitted to Japan from abroad" means, among the amount remitted and received by nonpermanent residents from abroad to Japan each year, "the amount exceeding the amount of the income other than foreign source income paid abroad" in that year.

In other words, the foreign source income of the year of remittance and the money remitted itself do not have to be tied together!

Amount of remittance and taxable income

I would like to explain this with the following Case.

【 Case 】

- A British man sent the entire amount of 15 million yen in March 2022, earned by selling real estate in the UK ten years ago.

- He came to Japan three years ago and started his business in Japan, while depositing listed foreign stocks at a security firm in Japan and a security firm in the US.

- He had an income of 20 million yen from selling all shares held by the US firm(acquired for 10 million yen) in January 2022.

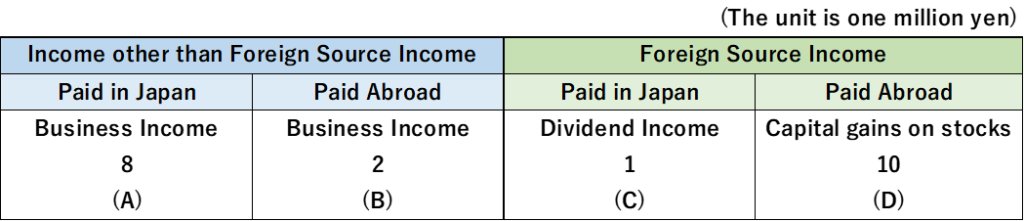

- The table below shows the breakdown of his income for the 2022 tax return, while he, as a non-permanent resident, remitted and received 15 million yen from the UK to Japan.

【Case answer】

- Among the 12 million yen (B+D) paid abroad, the 2 million yen (B) portion is first deemed to be the remittance of the income other than foreign source income paid abroad.

- Then the remaining 13million yen are considered to be the remittance of the foreign source income born abroad 10 million yen(D), which will be taxed accordingly.

- If (B) portion, which is taxed as an "income other than foreign source income", was a 16million yen, there should be no surplus in the remittance of the foreign source income born abroad. No "Remittance Taxation."

What we can see from the above

You may tax against not only cash remittances from the year's income but also remittances of proceeds on past earnings.

(As I mentioned above, the foreign source income of the year of remittance and the money remitted itself do not have to be tied together)

On the contrary, if there is no foreign payment of foreign source income in the year when the remittance from overseas is received, no "remittance tax" will be levied, no matter how much you remit to Japan.

You may be taxed not only on remittances from countries(i.e. the US) with income in the year but also on those from other countries(i.e. the UK).

At the end

Money has no colour and is indistinguishable.

If you come to Japan and make some investment with proceeds overseas, you may be taxed unexpectedly.

You would be wise if you examined in advance "when and how much money should I bring to Japan?"