income tax

Key points when foreigners apply for permanent residency in Japan(①): “Exit Tax from Japan” on unrealized capital gains.

According to a report by the Nikkei Shimbun on August 21st, the Japanese government will take budgetary measures to allow foreign residents to apply for permanent residence online from fiscal 2025. The government aims to attract more foreign workers and expects to increase the number of applications for permanent residency. Indeed. We will see increased […]

Can the renovation costs before starting the real estate leasing be necessary expenses for the year?

During my participation in free consultations for general taxpayers hosted by the Certified Public Tax Accountants Association, I am frequently asked a common question. To newly rent an old house or condominium to a third party, they undergo renovation work such as:・Reupholstering of “tatami” or mats, flooring, “fusuma” or wallpaper,・Renewal of plumbing equipment such as […]

Benefits of having a bank account dedicated to freelance work

I often receive the following question from ex-pats starting freelance work in Japan. "I'm thinking of using the blue return system, but how should I think about the bank account to receive revenues? I have already opened a payment account for a credit card for personal shopping, etc. Is it okay to use it for both […]

Are derivative transactions in foreign markets subject to separate or comprehensive Taxation?

An increasing number of individual investors are conducting derivative transactions in foreign markets through securities companies headquartered overseas, with underlying assets such as foreign stocks, foreign stock indices, and foreign exchanges. The prices of these derivative transactions generally fluctuate more than the price fluctuations of the underlying assets. As a result, the investor enjoys more […]

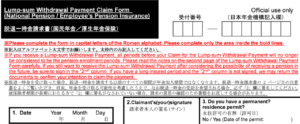

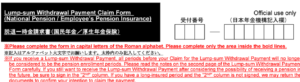

Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension" (Part 2)

Today, following Part 1 of my blog dated October 12, "Lump-sum Withdrawal Payments from the Employees' Pension(Part 1)," I will introduce points to keep in mind when filing a tax refund return. The waiting period till receiving the payment First, it takes 3 to 4 months from submitting the "Request for Lump-sum Withdrawal Payment" to […]

Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension"(Part 1)

I firmly notice that inquiries or consultations have increased about income tax on lump-sum withdrawal payments from Employees’ Pension, etc., from those who leave Japan to reside in other countries. The lifting of travel restrictions to prevent Covid-19 may affect this. I want to explain the following points in this and the following blog: What […]

Business commencement expense(Kaigyou-hi、in Japanese)

Business commencement expense(Kaigyou-hi、in Japanese)is an item related to all people who start a self-employed business in Japan, regardless of nationality. However, not all the expenses incurred before opening a sole proprietorship can not be business commencement expenses. If you apply wrongly, the tax office may point out you. On the other hand, a better understanding […]

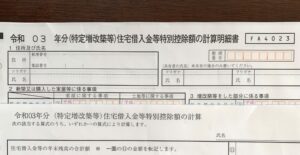

Foreigners in Japan are also eligible for housing tax credits.

Last month, the Nation Tax Agency announced roadside prices for 2022.(“Roadside prices”, Rosen-ka(路線価)in Japanese, are assessed values of lands facing a major road for inheritance tax and gift tax purposes.) According to it, compared to 2021, the land price has risen the most in Hakuba Village, Nagano Prefecture. National newspapers reported that the main reason […]

Necessary expenses:Part1

There is an article on the National Tax Agency (after the NTA) website about the scope of "necessary expenses." "Necessary expenses" sound plain and easy, but it's hard to explain to taxpayers. I pay tribute to the NTA for summarizing this subject in English. But, it is undeniable that there is a lack of further […]

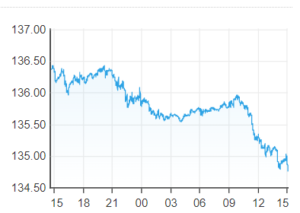

Just "foreign exchange rate", but "foreign exchange rate."

The yen depreciation or fluctuations in the exchange rate are reported daily. Today, with people such as below in mind,・ Foreigners living in Japan who have properties in their home country,・ Or a Japanese who returned to Japan while making financial assets locally when assigned, I will describe the yen conversion rate when conducting transactions […]