Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension" (Part 2)

Today, following Part 1 of my blog dated October 12, "Lump-sum Withdrawal Payments from the Employees' Pension(Part 1)," I will introduce points to keep in mind when filing a tax refund return.

目次(Table of contents)

The waiting period till receiving the payment

First, it takes 3 to 4 months from submitting the "Request for Lump-sum Withdrawal Payment" to the Japan Pension Service (after, JPS)until you receive the lump-sum withdrawal payment from the Employees' Pension.

To be honest, it is long.

Moreover, this waiting period of "3 months to 4 months later" is a case where there are no defects in the submitted documents.

If there are any deficiencies, JPS will ask you to submit additional or proper documents, which will delay the receipt of the money.

And one more thing.

A "National Pension/Employees' Pension Lump-sum Withdrawal Payment Decision Notice" will be mailed along with the remittance of this lump-sum withdrawal.

It is an important document required for filing a return (described later) to receive a tax refund withheld at the source.

When can you file a tax return for a refund?

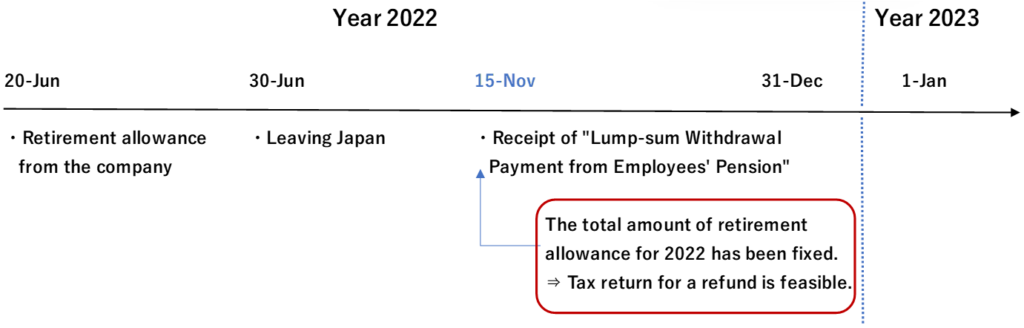

As a general rule, it is after January 1 of the year following which you received the lump-sum withdrawal payment from the Employees' Pension.

However, even before that date, if the total amount of retirement benefits you'll receive during the year is fixed, you can submit the tax return since then.

Points to keep in mind when filing tax returns for refunds

Appointment of a "Tax Agent"

When filing the tax return for a refund, you no longer have an address or place of residence in Japan.

Therefore, you must submit the "Notification of Tax Agent for Income Tax/Consumption Tax" to the tax office with jurisdiction over your final address or place of residence in Japan to file the return on your behalf.

Usually, before you leave Japan, you will appoint a tax agent.

Documents and infromation required for the return

"Notice of the Lump-sum Withdrawal Payment Determination" from JPS or a copy thereof

The tax office requires to attach the notice to the declaration form.

For your reference, this notice shows you the followings:

- Amount of lump-sum withdrawal on a gross basis,

- Withholding tax amount (including Special Income Tax For Reconstruction),

- Payment amount after deducting withholding tax amount.

"Withholding tax slip or record of retirement income" or a copy thereof

When you, now a non-resident, apply retirement income deductions in the same way as a resident by filling out the "Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer's Option" to the tax office, other retirement benefits(※) received during the same year in which you receive the lump sum are also subject to tax calculation.

(※)Examples: Lump-sum retirement allowances from the company upon retirement, lump-sum termination payment for corporate pension contracts, and others.

Bank account to receive refunded tax

There are two ways, in principle:

- Your bank account in Japan, or

- your tax agent's account in Japan.

Each has pros and cons.

The advantage of the former is that you can have a complete tax refund in Japanese Yen.

The National Tax Agency bears a bank transfer cost in refunding tax to your bank account as far as banks are in Japan.

But you must keep your bank account in Japan open for a while.

And after receiving the lump sum, you have to make the procedure to close it from outside of Japan.

As for the latter, the tax office also transfers the full amount.

However, you own the risk of whether the tax agent will properly send the money to you.

And it would be best if you decided how to share the bank cost of international remittance between the tax agent.

There's another way.

That is to receive your bank account outside Japan (i.e. your bank account in your home country).

Although the National Tax Agency's website does not clarify, the required procedure is for you to inform the tax office of the following account information in your name in writing, along with the tax return.

① Currency

② Bank name

③ Branch name and location

④ Account number

⑤ Bank code information (*) such as IBAN, BIC (SWIFT code), Routing Number

* Varies depending on the country where the account opens. Please check with your tax office which has jurisdiction over your place.

But also, here, you should be aware that you are subject to bank-international-transfer costs and foreign exchange fluctuations.

The tax office does not bear both.

No "Deductions from income", including "Basic exemption"

Concerning "Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer's Option", you cannot apply "Deductions from income" such as "Exemption or special exemption for spouses", "Exemption for dependents", or even "Basic exemption".

On the other hand, these deductions are allowed in non-resident tax calculations for other income subject to comprehensive taxation (i.e. real estate income).

I hope you don't get them mixed up.

At the end

That's all for today. Until the end, thank you very much for reading.

For your inquiries, please click the button below, fill in the prescribed form, and send it.