non-resident

Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension" (Part 2)

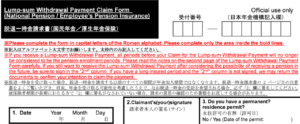

Today, following Part 1 of my blog dated October 12, "Lump-sum Withdrawal Payments from the Employees' Pension(Part 1)," I will introduce points to keep in mind when filing a tax refund return. The waiting period till receiving the payment First, it takes 3 to 4 months from submitting the "Request for Lump-sum Withdrawal Payment" to […]

Tax Return for Refund Due to Taxation on "Lump-sum Withdrawal Payment from Employees' Pension"(Part 1)

I firmly notice that inquiries or consultations have increased about income tax on lump-sum withdrawal payments from Employees’ Pension, etc., from those who leave Japan to reside in other countries. The lifting of travel restrictions to prevent Covid-19 may affect this. I want to explain the following points in this and the following blog: What […]

A "non-permanent resident" Part 1

What is a "non-permanent resident"? Under Income tax law, the scope of taxable income is determined by your residential classification. It is vital to make sure what your classification is or will be. First, you are divided into a non-resident or a resident if you have maintained residence or domicile in Japan for more than one year until now. […]