Are derivative transactions in foreign markets subject to separate or comprehensive Taxation?

An increasing number of individual investors are conducting derivative transactions in foreign markets through securities companies headquartered overseas, with underlying assets such as foreign stocks, foreign stock indices, and foreign exchanges.

The prices of these derivative transactions generally fluctuate more than the price fluctuations of the underlying assets.

As a result, the investor enjoys more profits than expected or suffers from unexpected losses.

However, securities companies with overseas headquarters do not support Japan's" specific account system" to reduce tax return procedures.

Investors must correctly calculate and file tax returns for gains and losses related to settling differences in derivative transactions by themselves.

Then, I have had inquiries about foreign market derivatives transactions, but one of them is very peculiar.

Namely, "I understood the profit and loss related to the settlement of this difference is miscellaneous income but is it subject to special exceptions such as separate taxation, or is it comprehensive taxation?"

Some individual investors who ask me questions say, "Different tax accountants give different answers. I'm at a loss because I don't know which is correct."

The answer is comprehensive taxation.

To correctly understand this, I will write the following while referring to the relevant part of the Financial Instruments and Exchange Act (after this, referred to as the FIEA) that the Income Tax law cites in its article.

目次(Table of contents)

How is it described in the National Tax Agency's "Guide" or "Instructions"?

The National Tax Agency has released the "Explanation of Miscellaneous Income Related to Futures Transactions" as an explanation for taxpayers who want to apply for preferential treatment such as separate taxation and carrying forward losses on their Japanese tax return for three years.

Let's see this.

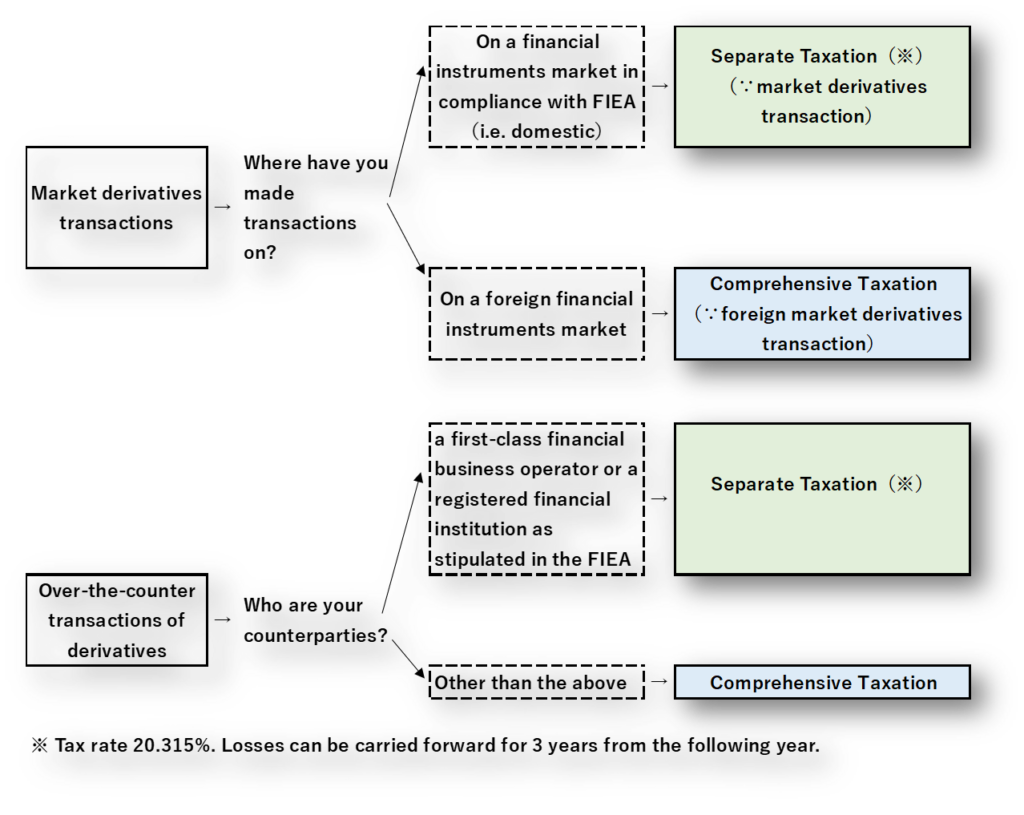

Summarised in a table format, the "financial instrument futures transactions, etc." covered by this Separate Taxation are defined as follows (the blog writer adds bold letters).

| Market derivatives trading | Over-the-counter derivatives trading |

| The following transactions stipulated in Article 2, Paragraph 21 of the FIEA. ・Forward trading ・Index forward trading ・Option trading However, from May 2020, items related to crypto assets or financial indices are excluded. | The following transactions conducted over the counter listed in Article 2, Paragraph 22 of the FIEA. ・Forward trading ・Index forward trading ・Option trading ・Index option trading However, futures transactions conducted on or after October 1, 2016, are limited to those executed with financial instruments business operators engaged in type 1 financial instruments business or registered financial institutions as counterparties. |

Keywords like "Market derivatives trading" or "Option trading" jump into your eyes.

If we focus only on these points, we may interpret that "Derivative transactions in foreign markets are also subject to separate taxation!"

However, to understand this correctly, it is essential to have an accurate understanding of the structure of the FIEA, that is, what Article 2, Paragraphs 21 and 22, etc., refer to.

Let's re-consider which is correct while checking the textual structure of the FIEA.

The structure of the FIEA

The FIEA defines or conceptualises "derivative transactions," which are the main subject of regulation, in Article 2, Paragraphs 20 through 25.

The National Tax Agency's manual above cites the articles of the FIEA.

For an accurate understanding, it is crucial to have a correct overview of Article 2, Paragraphs 20 to 25 of the FIEA.

Below is the structure of the relevant part.

Paragraphs 20 and 23, particularly relevant to this matter, are written verbatim (※)(the blog writer adds bold letters).

(※)Source:Japanese Law Foreign Language Translation DB System

| Paragraph 20 | The term "derivative transactions" as used in this Act means market derivative transactions, over-the-counter derivative transactions, or foreign market derivative transactions. |

| Paragraph 21 | (Detailed Definition of "Market Derivative Transactions") |

| Paragraph 22 | (Detailed definition of "over-the-counter derivative transactions") |

| Paragraph 23 | The term "foreign market derivatives transaction " as used in this Act means a transaction that is conducted on a foreign financial instruments market and is similar to a market derivatives transaction (excluding those associated with the financial instruments (limited to those set forth in item (iii)-3 of the following paragraph) or financial indicators (limited to the prices of the financial instruments and the figures calculated based thereon)). |

| Paragraph 24 | (Definition of "Financial Instruments") |

| Paragraph 25 | (Definition of "financial index") |

In other words, the FIEA defines "derivative transactions" as follows.

- In paragraph 20, which precedes paragraphs 21 and 22, "derivatives transactions" are divided into three categories: "market derivatives transactions," "over-the-counter derivatives transactions," and "foreign market derivatives transactions."

- Then, in paragraphs 21 to 23, define each in detail.

- In addition, paragraphs 24 and 25 clarify "financial instruments" and "financial instruments" in these definitions.

The answer; Comprehensive Taxation

Did I make it clear?

Paragraphs 21 and 22 of Article 2 of the FIEA, which serve as the grounds for separate taxation and carry-forward deductions for losses in the Income Tax Law, do not allow room for "foreign market derivative transactions, " defined first in paragraph 23 of the FIEA.

Therefore, you cannot apply separate taxation to foreign market derivatives transactions.

Comprehensive taxation is the only way to calculate income tax.

Also, even if there is a loss, it cannot be combined with the amount of income other than miscellaneous income, nor can it be carried over to the following year.

For your reference: An industry association of Japanese securities firms recognise the taxation as comprehensive.

The Japan Securities Dealers Association, an association functioning as a self-regulatory organization and an interlocutor for the securities industry, has long been concerned that foreign market derivatives transactions are comprehensive taxation.

The following is the relevant part of the "Request for Tax Reform for FY2023" compiled by the Japan Securities Dealers Association, the Investment Trusts Association, and the Japan Securities Exchange Council in September this year.

Profits and losses related to settling differences in foreign market derivatives transactions, under the current tax law, subject to comprehensive taxation, should be subject to separate taxation and be included in the scope of offset of loss.

From the fifth page of the above "Request"( The original text is in Japanese only. English translation is by the blog author.)

At the end

Thank you very much for reading to the end.

Tax laws often need help understanding.

Especially derivative transactions in foreign markets are even more so because the Income Tax Law cites the content of the FIEA.

As a summary, I put a flow chart of the classification process below.