Key points when foreigners apply for permanent residency in Japan(②): Overseas property inherited from parents living in the home country is also taxable.

Today is the second column about points foreign nationals need to remember when obtaining permanent residence.

One specific scenario I will examine is when foreign individuals residing in Japan inherit property from their parents who live overseas.

In such cases, it is essential to understand how the Japanese inheritance tax will be applied to the acquired property.

The key is whether the "overseas/foreign property" will be subject to taxation.

In summary, I would like to summarize the conclusion.

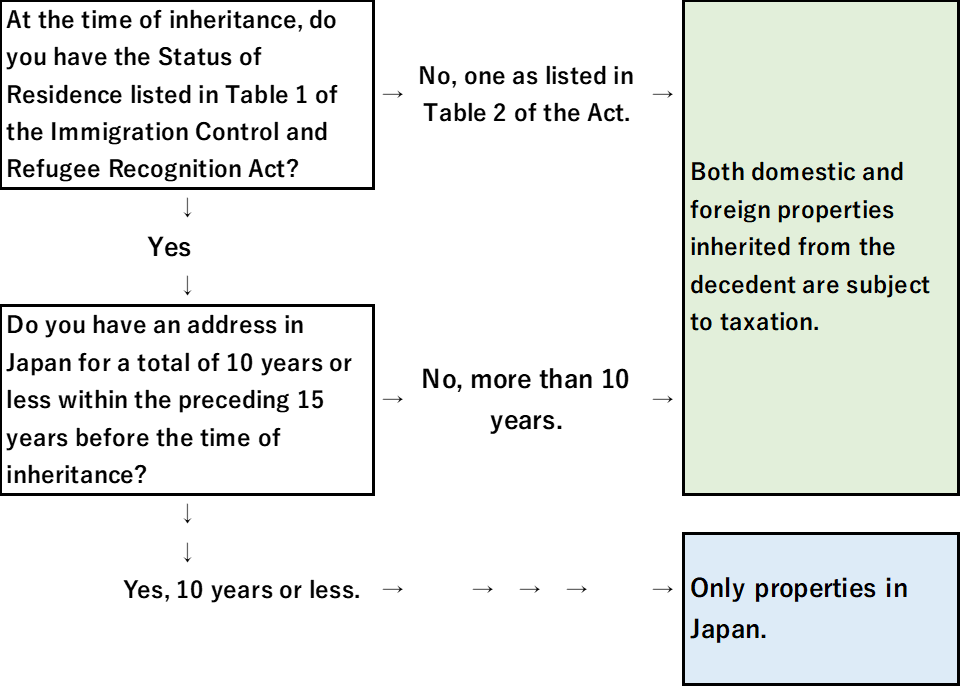

- Foreign personnel residing in Japan with a status of residence granted when working as a highly skilled professional, manager, etc. (Status of Residence listed in Schedule 1 of the Immigration Control Act):

If the period of residence in Japan is ten years or less, even if a relative in your home country inherits the property, that "overseas property" is not subject to Japanese inheritance tax. Only "domestic property" is subject to tax. - Foreign personnel residing in Japan with a Status of Residence listed in Appended Table 2 of the Immigration Control Act, such as so-called permanent residence:

Regardless of Japan's residence period, "overseas property" is also subject to inheritance tax.

In the next blog, we will discuss a case where a foreign national living in Japan dies; in other words, one becomes the deceased.

目次(Table of contents)

- 1 ”Domestic Property" and "foreign Property"

- 2 When a foreign national resides in Japan with a residence status listed in Appended Table 1 of the Immigration Control Act.

- 3 If you reside in Japan with the Status of Residence listed in Table 2, such as a permanent resident.

- 4 Other: What if inheritance occurs after foreign personnel leave Japan?

- 5 At the end

”Domestic Property" and "foreign Property"

First, how does the inheritance tax law distinguish between "domestic property" and "foreign property"?

The law stipulates the "location of property" for each asset. The main ones are listed below.

| Type of asset | How to consider "Location" |

| Real estate | The location of real estate ・For example, a "condominium in Hawaii" is a "foreign property" because it is real estate located in Hawaii. |

| Bank savings, etc. | The location of the business office that accepted the deposit, savings, etc ・It is based on the location of the branch where the deposit account is located, not the head office/location of the bank.For example, a deposit opened at the Tokyo branch of a bank headquartered in the UK is considered "domestic property." |

| Insurance, incluging rights in the contract of insurance | The location of the head office of the insurance company, etc |

| Securities such as stocks and corporate bonds are held in custody at security firms, etc. | The location of the security firm's business office where the account is open |

| Government bonds or local bonds | ・If it is a Japanese government bond or a Japanese local government bond, it is "domestic property." ・A government bond issued by a foreign government or a municipal bond issued by a foreign municipality is "foreign property." |

When a foreign national resides in Japan with a residence status listed in Appended Table 1 of the Immigration Control Act.

I have written about the residence status in detail in my previous blog.

Please see below.

→ Key points when foreigners apply for permanent residency in Japan(①): “Exit Tax from Japan” on unrealized capital gains.

In the case of the Status of Residence listed in Appended Table 1 of the Immigration Control Act, there is another determining factor in addition to the residence status.

When the inheritance occurs, the question is whether your or heirs’ total period of residence in Japan within the preceding 15 is equal to or less than ten years.

The critical thing to keep in mind here is the "total period."

Let's say that within the past 15 years, there was one or more periods in which you did not have an address in Japan.

In that case, calculate the total period by adding up the multiple periods during which you had an address in Japan.

And within 15 years before the inheritance:

- If the "total period" of residence in Japan is less than ten years, "overseas property" is not subject to inheritance tax.

Taxation is only applicable to "domestic property." - On the other hand, if the "total period" exceeds ten years, not only “domestic property” but also "foreign property" will be subject to tax.

Suppose you have stayed in Japan for over ten years in the past 15 years.

In that case, you are considered to have a strong relationship with Japanese society, even if it is to work, and your foreign assets will be taxed just like "ordinary Japanese."

If you reside in Japan with the Status of Residence listed in Table 2, such as a permanent resident.

Inheritance tax applies to both domestic and foreign property owned by the deceased, regardless of their length of stay in the country.

The government does not restrict activities during one's stay, so the period of residence is not a factor in determining tax liability.

As a result, all property, including assets held overseas, will be subject to taxation as if the deceased were a regular Japanese citizen.

Below is a "judgment flow" to summarize things so far.

Other: What if inheritance occurs after foreign personnel leave Japan?

In this scenario, a person of foreign nationality inherits property from their parents who reside outside Japan after leaving the country.

It's worth noting that inheritance tax doesn't apply to foreign property, regardless of how long the person lived in Japan or their residency status.

The tax only pertains to domestic property.

At the end

Thank you for taking the time to read this blog.

It's important to note that due to the 2017 tax reform, even foreign nationals may be subject to inheritance tax.

However, some exceptions are in place to encourage highly skilled foreign professionals to come to Japan.

If the heirs are foreign nationals with a work visa and have lived in Japan for ten years or less in the 15 years before the inheritance, properties outside of Japan will not be subject to taxation.

It's essential to be aware that if you decide to obtain permanent residence in Japan or become a fan of the country and choose to stay for an extended period, this exception no longer applies.

This can be difficult for foreign workers with elderly parents in their home countries.

In my next update, I will share a case of a foreign national residing in Japan who has passed away or become a decedent.

Thank you again for reading.